The new UK Budget marks a significant increase in the UK’s tax burden, underlining all the more why Guernsey remains a compelling option for those seeking tax‑efficiency, stability, and quality of life.

What’s changed in the UK

- The UK government is raising an estimated £26 billion in new taxes over this Parliament.

- Income tax and National Insurance thresholds will remain frozen, effectively pushing more people into higher tax bands over time.

- Taxes on property income, dividends, savings and high‑value homes are increasing. Among the most notable is a new ‘mansion tax’ on residences over £2 million, affecting landlords, investors and families with valuable properties.

- The tax on income from assets, previously often more lightly taxed than earned income, is being brought more in line with wages.

Why Guernsey stands out

Against this backdrop, Guernsey remains very appealing for several reasons:

- No capital gains tax, no inheritance tax and no VAT.

- For those relocating under the Open Market rules, there is a tax cap of £60,000 per annum, covering almost all income (overseas and Guernsey) for up to four years. The only exception is income from Guernsey land or buildings which is taxed at 20%.

- To qualify for the tax cap, an individual simply needs to become resident in Guernsey and purchase an Open Market property with sufficient document duty paid (currently equating to a property purchase of around £1.4 million or more), either within 12 months before or after taking up residence.

Given this week’s UK Budget, it makes Guernsey look exceptionally attractive, especially for individuals with overseas income, investments or high‑value property interests.

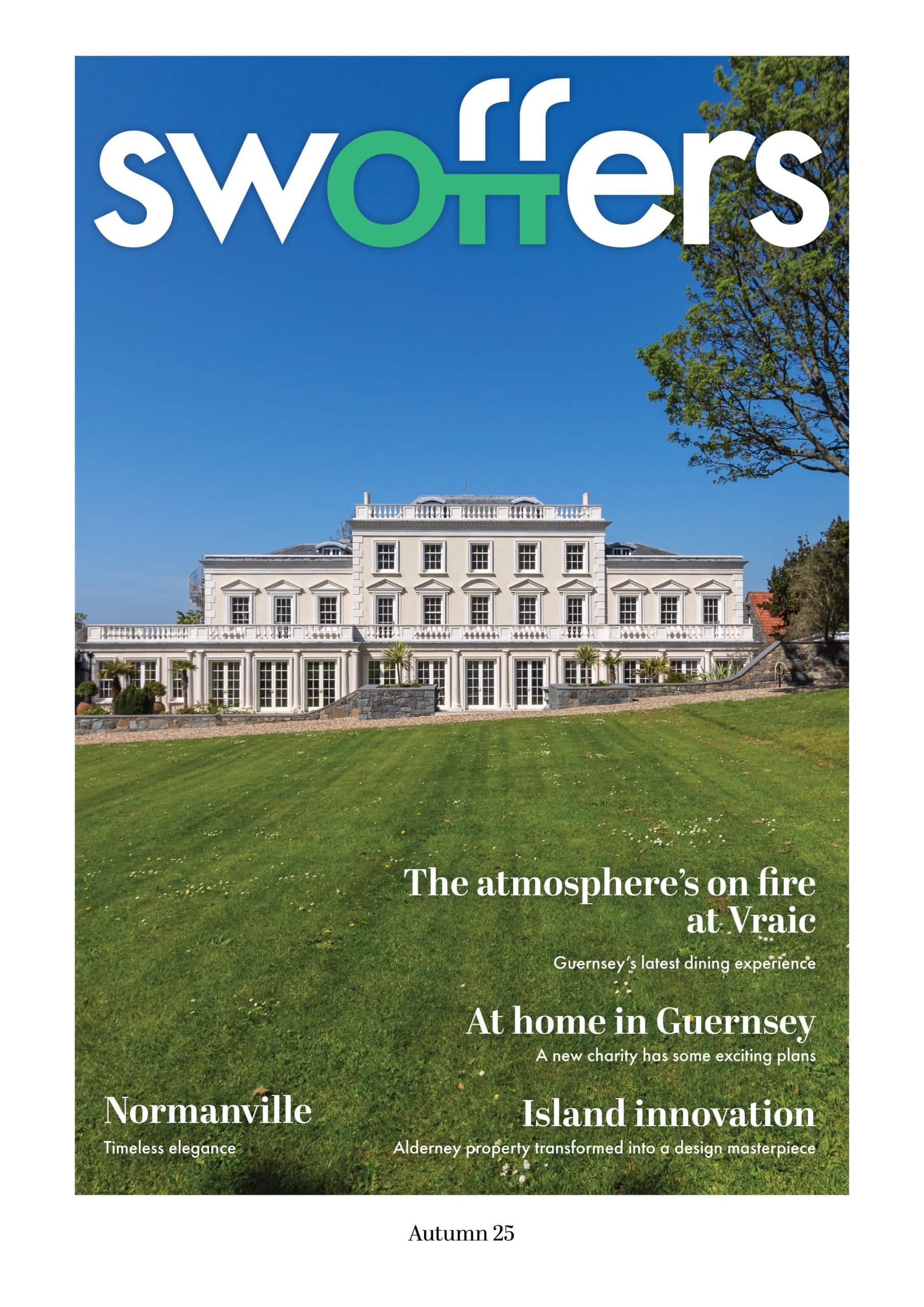

A stable, beautiful alternative

Beyond tax, Guernsey offers much that the UK doesn’t: a peaceful island lifestyle, close‑knit community, high levels of safety, and easy access to Europe while remaining within a familiar and financially efficient UK‑linked jurisdiction.

For many, the choice is becoming clearer. With tax pressure rising in the UK, Guernsey’s combination of low taxes and lifestyle benefits makes it not just appealing, but increasingly compelling.

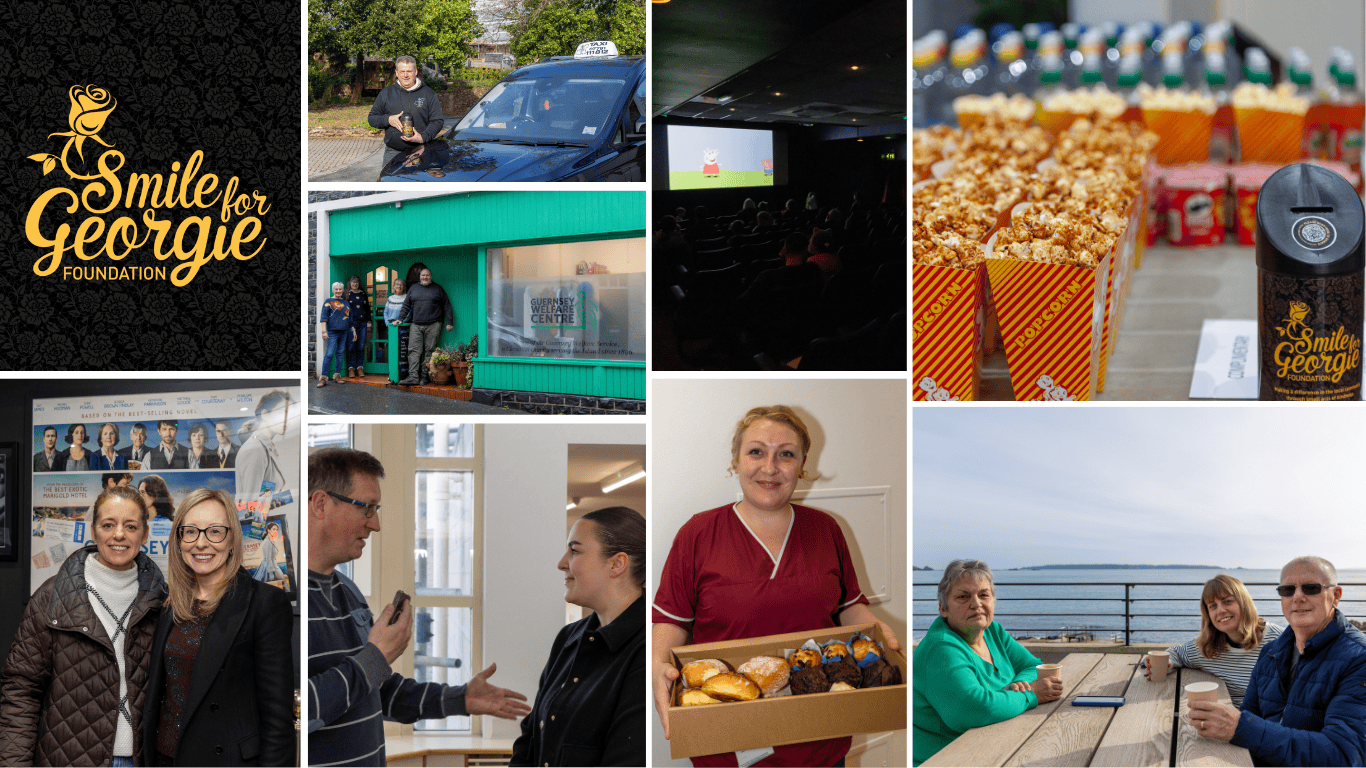

Alex Stuart, Swoffers Open Market Negotiator, said: “With the latest UK Budget adding yet more pressure on taxpayers, we’re seeing a clear rise in interest from individuals and families looking for a more stable and secure alternative.

The Open Market remains an attractive route for relocation, not only because of the lifestyle and safety the island offers, but also thanks to the tax cap available to new residents. For many people reviewing their options, Guernsey is proving to be a safe haven that delivers both financial stability and an exceptional quality of life.”