Swoffers director Craig Whitman looks at some of the reasons currently driving people to explore relocating to Guernsey.

As a direct result of the recent UK budget, Swoffers has experienced a rise in enquiries from people worried about increases in Capital Gains Tax and Inheritance Tax, and from those non-UK domiciled individuals who are facing enormous changes.

Capital Gains Tax (CGT)

Capital Gains Tax has long been a focal point for wealthy individuals, particularly as the UK government has progressively lowered the CGT annual exemption. This budget increased the effective tax rate to 18% for lower rate taxpayers and 24% for higher rate taxpayers with effect from October 2024.

In stark contrast, Guernsey does not impose any CGT. This difference alone can be a major attraction for investors and business owners who want to preserve more of their wealth when disposing of assets.

Inheritance Tax (IHT)

The UK budget has also focused on Inheritance Tax. Rising property values and the freezing of IHT thresholds pushes more estates into the IHT net. UK residents face an IHT rate of 40% on the value of estates over £325,000 (or £500,000 in certain circumstances).

From 6 April 2027, unspent pensions will be brought into the scope of IHT. Currently pensions assets are considered outside the estate and so escape the 40% tax.

Guernsey, however, has no IHT. This means that families relocating to Guernsey can transfer assets between generations without incurring a hefty tax bill.

The Non-Domiciled Regime (non-dom)

One of the most profound changes in the UK tax landscape is the abolition of the long-established non-dom regime, which has allowed non-domiciled individuals to avoid paying UK tax on foreign income, provided they do not remit those earnings to the UK. By eliminating the non-dom status, the UK government has removed a major incentive for wealthy foreign nationals to reside in the UK.

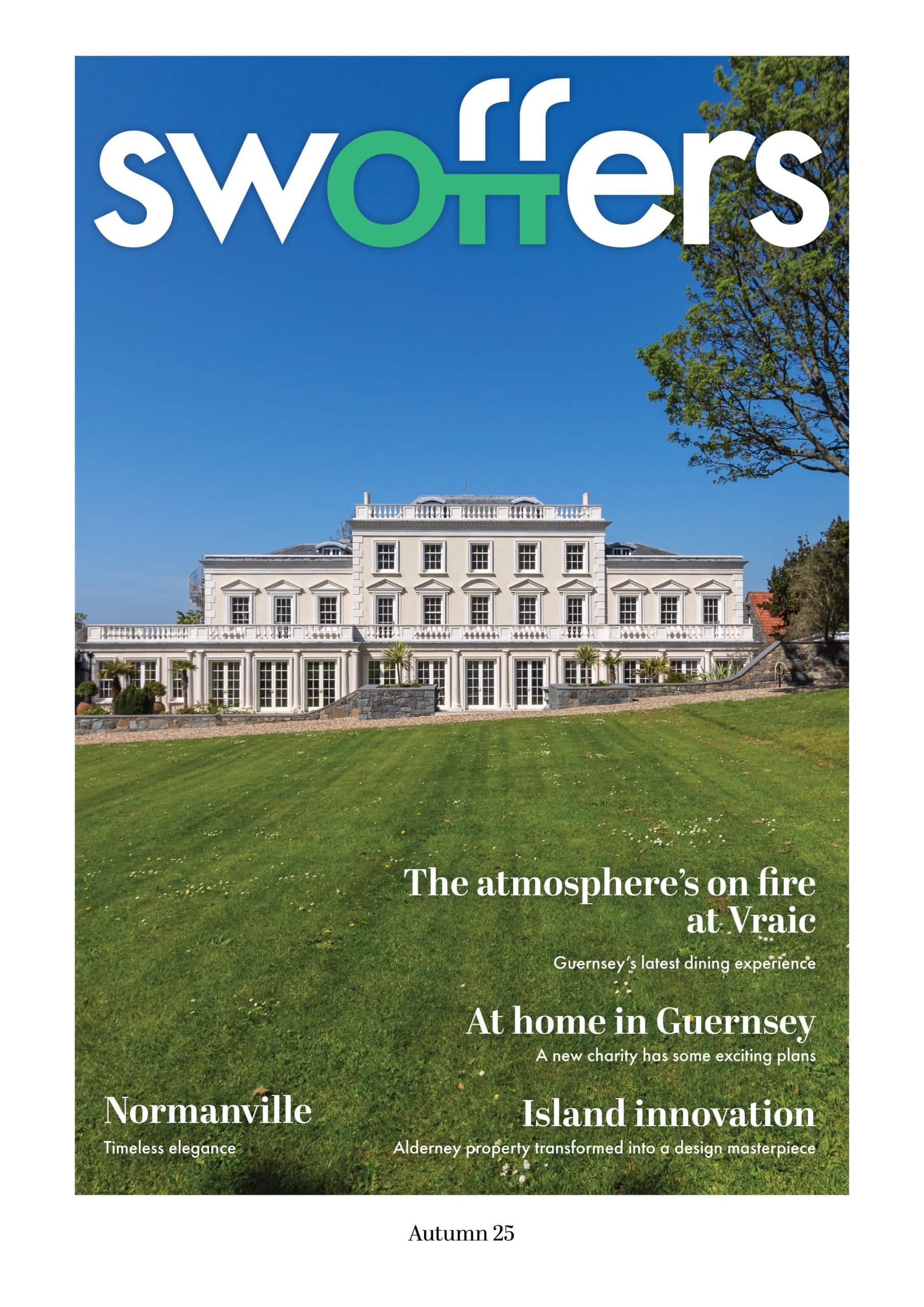

Guernsey, in comparison, operates a more flexible approach towards the taxation of individuals, offering residents considerable tax advantages. Guernsey has a current headline income tax rate of 20%. In addition, there are several advantageous tax caps for Guernsey residents, including a maximum liability of £160,000 per year. These provisions make Guernsey particularly attractive to high-net-worth individuals who seek to minimise their tax on worldwide earnings and wealth. We would recommend that you contact a tax adviser for more detail on Guernsey’s tax caps which include a £60,000 cap if you purchase an Open Market house for £1.4m or more.

Guernsey’s attractive tax regime: summary of key differences

The differences in the tax treatment of capital gains, inheritance, and foreign income between the UK and Guernsey are stark and, in combination, offer significant advantages to residents of Guernsey:

- Capital Gains: Guernsey residents are not subject to CGT, whereas UK residents face up to 24% in CGT.

- Inheritance: Guernsey has no IHT, while the UK imposes a 40% (subject to available reliefs) tax on estates over certain thresholds.

- Foreign income: Guernsey offers a tax cap on non-Guernsey income, while the UK taxes global income for all residents following the removal of the non-dom status.

- Open Market tax cap: Purchase of a home in Guernsey does offer a four-year tax cap of £60,000 per annum.

A move to Guernsey for anyone in UK who holds a British, Irish, or BNO passport, or has settled status in the UK, is a very simple process. There are no requirements to guarantee a minimum tax contribution, you simply have to identify a suitable home.

Swoffers’ Open Market team would be delighted to help you find that home, and guide you to the tax professionals who can help with your tax planning.

Get in touch on 01481 711766 or email sales@swoffers.co.uk